AI for compliance in SMEs: lower risk, lower costs

Jan 2, 2026

Regulation is getting stricter, controls are increasingly digital, and the margin for error is small. For SMEs, that means more administrative pressure and higher risks, while budgets do not rise accordingly. The good news is that a practical use of AI for compliance can reduce both risk and cost. In this article, we show where AI can already deliver value safely today, how you can move from pilot to scale in 90 days, and which governance you need to pass audits with confidence.

What does “AI for compliance” mean in practice?

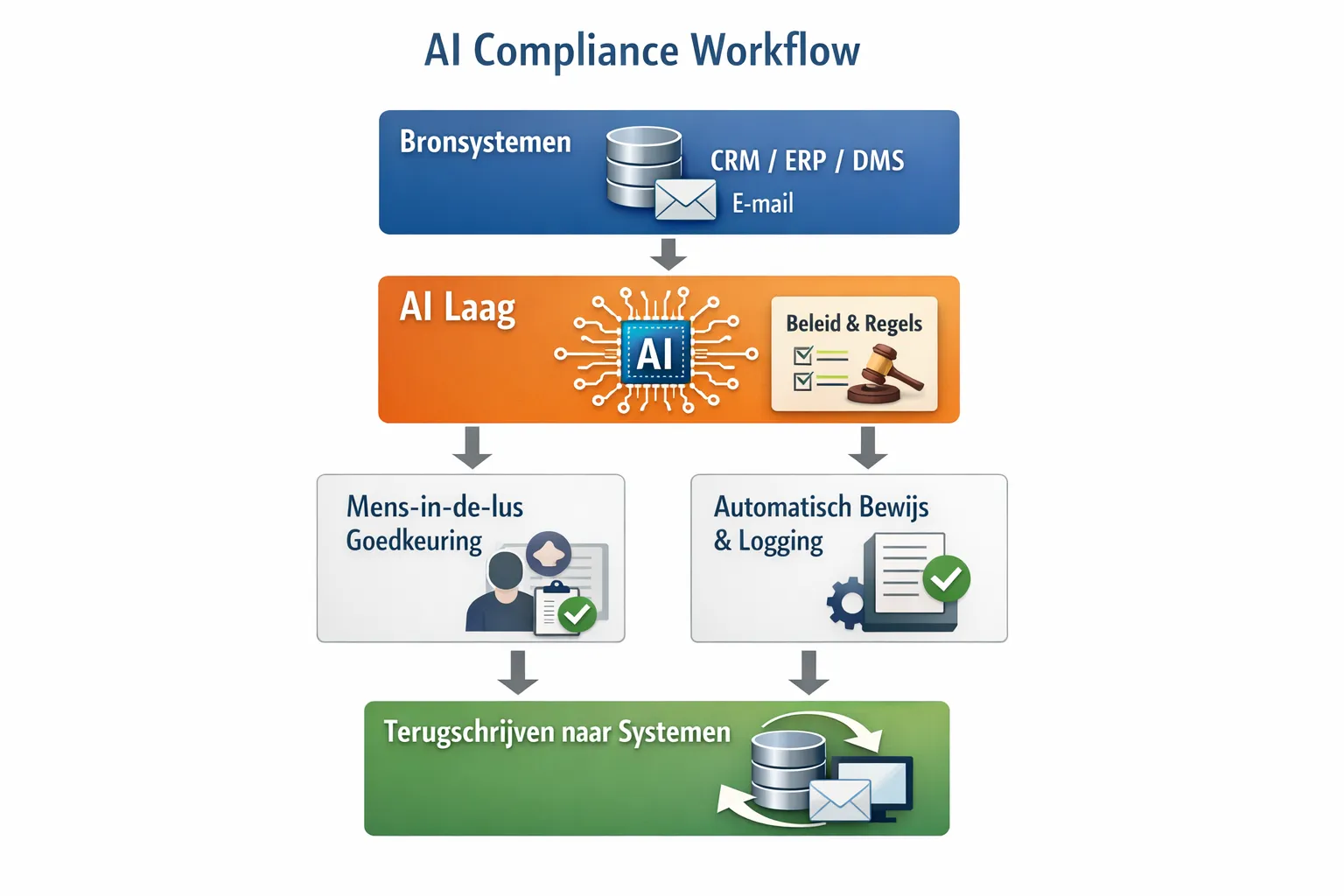

AI for compliance is not a magical black box. It is a combination of recognition, analysis, decision support, and case file building. In practice, it works like this:

AI reads documents, transactions, and communications, and identifies relevant fields or risks.

AI checks policies, laws and regulations, and contractual requirements, and compares them with the case.

AI makes a recommendation, including rationale and sources, after which an employee makes the decision.

AI automatically records what was checked, using which criteria, and what the outcome was.

The result is less manual work, fewer errors, and a complete audit trail. This does not replace lawyers or compliance officers, it accelerates work by taking routine tasks off their plates and reducing blind spots.

Where AI reduces risk

1) Privacy and GDPR

Automatic PII detection in documents and emails, including anonymization or masking where needed.

Faster handling of access, rectification, and deletion requests, including proof of timely and complete completion.

Enforcing data minimization and retention periods through rules per document type.

For background, see the Dutch Data Protection Authority (Autoriteit Persoonsgegevens) on GDPR and data subject rights here.

2) Contract and document review

Screening NDAs, purchasing terms, and SLAs for missing clauses or risky provisions, with clear red flags and suggested wording.

Consistent case file creation, every review uses the same checklist and includes a reference back to policy or law.

3) Product and supply chain compliance for wholesale and distribution

Checking technical files and product sheets for mandatory elements, certificates, CE references, and labeling text.

Verifying REACH and RoHS claims based on supplier documentation provided and internal policy requirements.

4) AML/KYC for accounting and real estate

UBO identification and sanctions and PEP screening through integrations with external sources, with a risk score and mandatory review intervals.

Signal detection for unusual transactions based on predefined patterns, after which a human assesses and AI prepares the report for the case file.

More about reporting obligations and case file documentation can be found at FIU-Netherlands here.

5) Information security and NIS2

Checking control reports for consistency and completeness, including reminders for periodic tasks such as access reviews and patch compliance.

Central, searchable logging of performed controls, useful during audits or incident investigations.

An accessible explanation of NIS2 is available at ENISA.

6) AI governance itself

The EU AI Act introduces obligations, including around risk management, data governance, transparency, logging, and human oversight. Deployers also have obligations, depending on the system’s risk level. An overview is available on the EU page about the AI Act.

Where AI reduces cost

Less repetitive reading and copying for contracts, forms, and certificates, saving hours per week per employee.

Faster cycle times and fewer external advisory hours because standard cases are assessed internally and consistently.

Less audit stress, evidence is built continuously and stored in a structured way.

Example calculation: if your team processes 300 documents per month and a manual check takes 8 minutes each, that equals 40 hours. If AI prepares 60 percent of these checks and leaves 2 minutes per document for human review, time spent drops to about 16 hours. At EUR 75 per hour, that is about EUR 1,800 per month in direct savings, excluding lower failure costs and faster cycle times.

Sector examples you can apply now

Wholesale and distributors, automatically check whether product documentation is complete, verify labels and safety data sheets match, flag export restrictions, and monitor supplier certificates with reminders.

B2B product suppliers, automatically triage warranty and conformity claims, detect deviations in technical specifications, and handle returns faster with stronger evidence.

Accounting firms and legal boutiques, AML onboarding with structured risk analysis, scan standard contracts for deviations, and continuously build a neatly logged case file.

Installation companies, monitor VCA and NEN certificates for employees and subcontractors, check handover documents and permit requirements per project, including automatic escalation.

B2B real estate brokers, KYC for tenants and landlords, sanctions checks, contract analysis for missing provisions, and case file documentation for later audits.

The building blocks of a safe AI compliance solution

Clear task boundaries, AI can prepare, humans decide. Set thresholds, below a certain score always escalate.

Retrieval over your own policies, use RAG so AI answers based on internal guidelines and up to date legislation, not general assumptions.

Privacy by design, PII detection and masking, role based access, encrypted storage, and limited retention periods per data category.

Full logging and traceability, store inputs, used sources, model version, prompt, and decision with timestamp. This is critical for audits and root cause analyses.

Testing and calibration, run periodic sampling, red team critical scenarios, and define acceptance criteria, for example minimum accuracy per control type.

Governance and human in the loop, assign process owners, define escalation routes, and ensure periodic review of rules and prompts.

If you want to go deeper on quality and risks, read our guide on a pragmatic AI check here.

A 30 to 60 to 90 day plan to lower risk and cost

Day 1 to 30, choose one high volume process with clear policy, for example contract screening or AML onboarding. Create a baseline for cycle time and error rates, run a compact risk analysis and, where appropriate, a DPIA. Build a pilot with RAG on your policies, clear checklists, and human in the loop. Measure accuracy and time savings on at least 50 cases.

Day 31 to 60, connect source systems such as CRM, ERP, and DMS, enable automated logging and evidence packs, and train employees on the workflow and the system’s boundaries. Refine prompts and rules based on real errors and missed signals. Calibrate thresholds to the desired balance between speed and assurance.

Day 61 to 90, harden and scale. Add a second control type, for example supplier due diligence, and expand dashboards with compliance KPIs. Put release management in place for prompts and models, including rollback scenarios. Update arrangements for external audits and document compensating controls where the AI still falls short.

For practical integration patterns and workflow ideas, you can consult our guide on AI driven process automation here, or our quick start guide for fast pilots here.

KPIs that actually matter

Cycle time per control type, start with a baseline and target a 30 to 60 percent reduction depending on complexity.

First time right, the percentage of cases that are audit ready without rework.

Number and severity of escalations, a downward trend with the same risk profile is a good sign.

Completeness of evidence, the share of cases with a complete checklist, source reference, and timestamp.

Cost per reviewed case, direct in hours and indirect through fewer audit findings and lower fine risk.

Common mistakes and how to avoid them

Starting too broad, do not pick ten policies at once. Start with one clearly scoped control type where rule texts are available.

No source management, do not let AI work on outdated or scattered documentation. Set up version control and a publishing process for policies.

Insufficient human oversight, explicitly define when a human decides and when automatic closure is allowed, and record that in the log.

No continuous monitoring, without sampling and quality measurements, accuracy drops after policy changes or model updates.

Unclear accountability, appoint a process owner and a risk owner, and schedule fixed review moments.

Moving frameworks, staying pragmatic

The EU AI Act will come into force in phases over the coming years. For SME deployers, it is especially relevant that you manage risks systematically, ensure human oversight, have data governance in order, and can explain how decisions were made. Combine this with GDPR principles and, where applicable, NIS2 obligations and AML requirements. By starting small and improving measurably, you comply faster and at lower cost with both the letter and the spirit of the rules.

How B2B GrowthMachine helps

B2B GrowthMachine builds and orchestrates AI workflows that make compliance work lighter and more reliable. We combine your policies and systems with a human in the loop approach, logging, and reporting, so you work faster while staying audit ready. With integrations to CRM, ERP, DMS, email, and APIs, the solution is not an island. And with continuous optimization, we improve performance and cost over time.

Less manual work and fewer errors, AI prepares, your team decides.

Lower costs and faster cycle times, with automated evidence for audits.

From pilot to scale quickly, without extra FTEs and with control intact.

If you want to prove within 90 days that AI can make your compliance faster, safer, and cheaper, schedule a short exploration via B2B GrowthMachine. We will discuss one concrete process and outline a feasible pilot plan with measurable KPIs. Then you decide based on facts, not gut feeling.