Benefits to AI: Where ROI Shows Up First

Jan 12, 2026

Most SME teams don’t struggle to “see the benefits to AI.” They struggle to see ROI.

That’s usually because they start AI in the wrong place: content experiments, disconnected pilots, or “cool” tools that never touch a business-critical workflow.

If you want ROI you can defend in a board meeting, you need to start where AI changes outcomes quickly: high-volume, repetitive work that sits directly on revenue, cash, and customer response time.

Why AI ROI shows up unevenly (and why that’s good news)

AI rarely improves everything at once. In B2B SMEs, the fastest ROI appears where three conditions are true:

Frequency: the task happens every day (or many times per day).

Friction: it steals real time through manual copy-paste, chasing info, or switching systems.

Financial impact: speed and accuracy change revenue, margin, or cost-to-serve.

The good news is that most wholesalers, distributors, B2B suppliers, accountancy firms, legal boutiques, installation companies, and B2B real estate brokers have dozens of these workflows.

The bad news is that many AI projects start somewhere else.

Common “ROI killers” we see:

AI outputs that are not connected to execution (nice summaries, no action)

No baseline metrics (you cannot prove improvement if you didn’t measure before)

No system access (AI without CRM/ERP context becomes generic)

No guardrails (teams stop trusting results after the first avoidable mistake)

If you flip those patterns, ROI shows up early.

Benefits to AI: where ROI shows up first (in real operations)

Below are the areas where ROI typically appears fastest in B2B SMEs, because they compress cycle time and remove labor from the critical path.

1) Speed-to-lead and follow-up (pipeline ROI)

In most B2B companies, leads do not die because the product is wrong. They die because response is slow and follow-up is inconsistent.

AI-driven automation can:

Route inbound leads to the right owner based on rules (industry, region, product line)

Draft a first response using your offer, proof points, and next step options

Create CRM tasks, update pipeline fields, and trigger a follow-up sequence

Flag “high intent” replies and escalate them immediately

Where the ROI comes from: more conversations started, fewer leads forgotten, shorter time-to-first-touch.

This is especially valuable for:

Distributors handling inbound quote requests across multiple product categories

Installation companies where every missed follow-up means lost site visits

Real estate B2B brokers who win deals by being first and most precise

2) Quote and pricing workflows (cycle-time ROI)

Quoting is a classic bottleneck in wholesale, distribution, manufacturing, and installation.

Even when pricing rules are clear, the process is slow because people must:

interpret the request

find the right SKUs or service bundles

validate availability, lead times, and terms

format the quote and send it

AI-supported quoting does not have to “decide the price.” Often the quickest ROI comes from automating everything around the decision:

Extracting structured requirements from emails or forms

Checking completeness (missing quantities, delivery address, preferred dates)

Pulling relevant product/service templates

Drafting the quote email and creating the CRM opportunity

Where the ROI comes from: reduced time-to-quote and fewer back-and-forth cycles.

In many B2B markets, faster quoting is not just efficiency, it is win rate.

3) Customer service intake and triage (cost-to-serve ROI)

Service teams carry hidden cost: status requests, basic troubleshooting, duplicate tickets, and manual routing.

AI can deliver fast ROI by handling the first mile:

Classify inbound messages by intent (order status, complaint, invoice question, technical issue)

Gather missing info automatically (order number, site address, serial number)

Suggest the right internal response or route to the right queue

Produce consistent answers grounded in your policies and knowledge base

Where the ROI comes from: fewer tickets per agent, shorter response times, and less context switching.

For wholesalers and distributors, this often starts with “Where is my order?” and “Can you resend invoice X?” because those are high-volume and predictable.

4) Finance operations: AP/AR and exception handling (cash ROI)

A surprising amount of AI ROI shows up in finance, not because AI replaces finance judgment, but because it removes admin drag.

Practical quick wins include:

Invoice intake: extracting fields and flagging missing PO numbers

Matching support: preparing a match package for approval (invoice, PO, receipt)

AR follow-ups: drafting reminders based on payment terms and customer history

Cash collection prioritization: flagging accounts that need attention first

Where the ROI comes from: fewer manual touches, fewer errors, and faster cash conversion.

This is also where AI becomes a risk reducer. When workflows are logged and standardized, you reduce the chance of “tribal knowledge finance.”

5) Operations scheduling and exceptions (throughput ROI)

In installation, field service, manufacturing, and distribution, the biggest cost is often not labor, it’s delay.

AI-driven workflows can help by:

Turning incoming requests into structured work orders

Detecting missing information early (access requirements, safety constraints)

Proposing schedule options based on capacity rules

Alerting teams when exceptions happen (late materials, incomplete documentation)

Where the ROI comes from: fewer reschedules, fewer failed visits, and better capacity utilization.

A quick way to pick your first AI use case (without overthinking it)

If you want ROI to show up early, pick a use case with the highest “boring impact.” Here’s a practical filter to use in a single workshop.

The ROI-first filter

A strong first AI workflow usually scores well on:

Volume: it happens at least weekly, ideally daily

Minutes per instance: each run saves real time (even 3 to 10 minutes adds up fast)

Cost of delay: slow handling causes lost deals, churn, penalties, or rework

Clear rules: there are obvious guardrails (when to escalate, when to stop)

Accessible data: the workflow can pull context from CRM/ERP/email or a knowledge base

Low downside risk: mistakes are recoverable (human approval where needed)

If you can’t access data yet, do not abandon the use case. Start by automating the intake, classification, and drafting steps, then integrate deeper once value is proven.

What to measure so ROI is undeniable

You don’t need complex dashboards to prove early ROI. You need the right operational measures tied to money.

Pick 2 or 3 metrics per workflow, such as:

Cycle time: lead response time, time-to-quote, time-to-resolution

Throughput: quotes per rep per day, tickets handled per agent

Quality: error rate, rework rate, escalation rate

Commercial outcomes: meetings booked, conversion rate, retained accounts

Then establish a simple baseline for two weeks. The baseline is what turns “benefits to AI” into finance-grade ROI.

Where ROI shows up first by industry (examples you can steal)

To make this tangible, here are common early-ROI plays for your sector.

Wholesale businesses and distributors

Start where you have high volume and repeatable decisions:

Quote intake from email to CRM with product matching suggestions

Order-status automation that pulls from your systems and sends proactive updates

Customer service triage that reduces back-and-forth

B2B product suppliers and manufacturers

Fast ROI often comes from reducing friction between sales and operations:

Automatic lead qualification and routing

Quote drafting and documentation completeness checks

Exception alerts when delivery constraints or production delays occur

Accountancy firms and legal/accounting boutiques

Here, ROI is usually “fewer interruptions and less manual prep”:

Inbox triage and document intake automation

Drafting client updates and gathering missing information automatically

Policy-grounded Q&A for internal staff so seniors get fewer repetitive questions

Installation companies selling to businesses

A classic ROI stack:

Structured job intake with completeness checks

Scheduling proposals with human approval

Automated pre-visit instructions to reduce failed visits

Real estate B2B brokers

Quick ROI tends to show up in speed and consistency:

Lead follow-up orchestration across channels

Automated meeting booking and pre-qualification

CRM hygiene automation (logging, next steps, reminders)

Don’t ignore “non-obvious” ROI: energy and procurement workflows

Some of the strongest ROI is hidden in spend categories that are painful, volatile, and time-consuming to manage.

Energy procurement and energy management are good examples. Even when you use external expertise, internal work still piles up: collecting site data, comparing proposals, tracking contract terms, managing renewals, and reporting.

If energy is a material cost driver in your business, it can be worth learning from organizations that specialize in commercial energy users, such as BVGE, the German association for commercial energy users, and then automating the internal workflows around data collection, approvals, and renewals.

The ROI here is not “AI predicts energy markets.” The ROI is reduced admin load and fewer missed deadlines in a process that affects cost directly.

How to get ROI fast (a pragmatic rollout that works)

Early ROI is not about installing “an AI.” It’s about shipping one production-grade workflow.

A practical approach for SMEs:

Start with one workflow and one owner

Pick a single workflow with a business owner who cares about the outcome (sales manager, operations lead, finance lead). “Everyone owns it” usually means no one does.

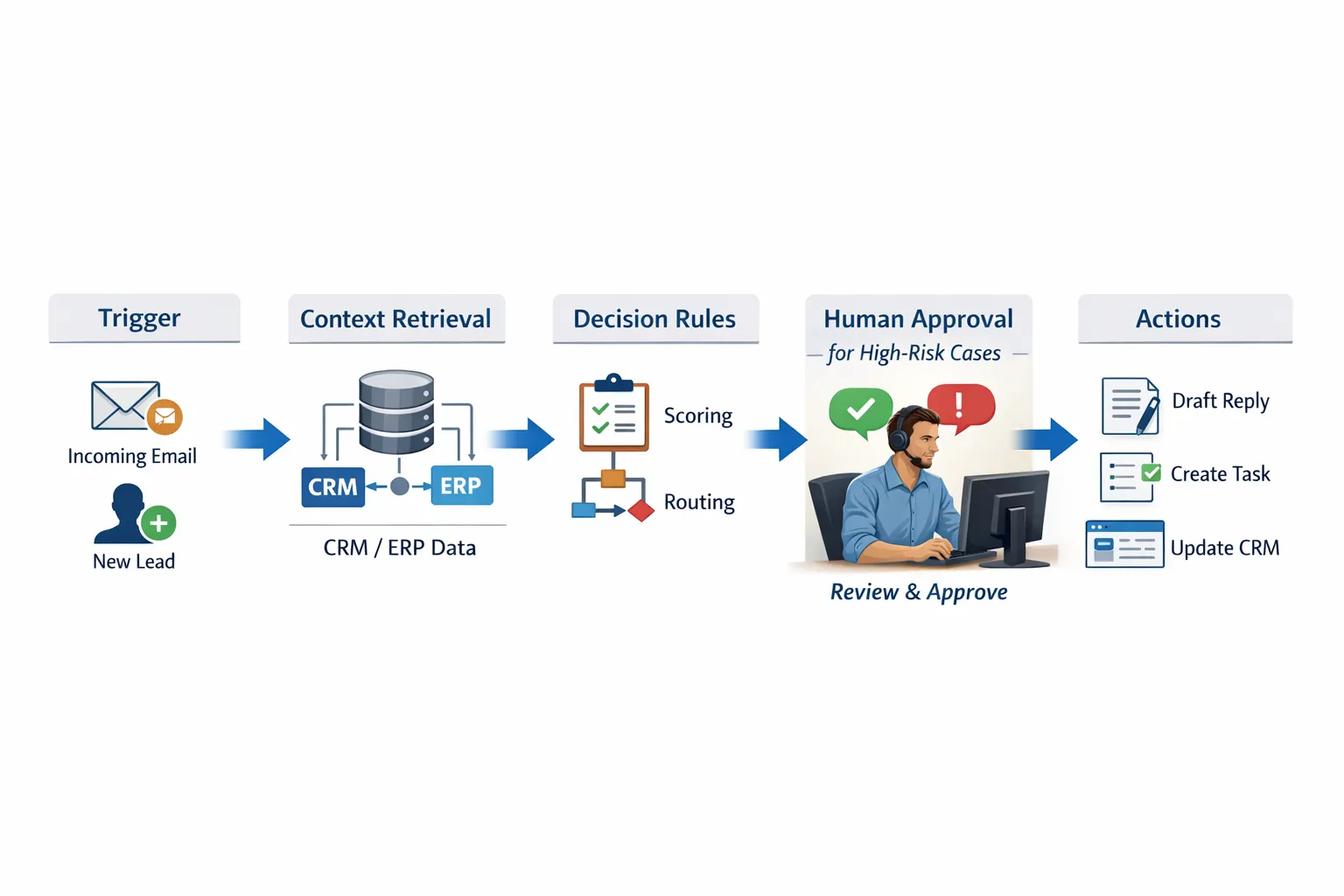

Build a controlled automation, not a free-form chatbot

The most reliable ROI comes from automations with:

a clear trigger (new lead, new email, new ticket)

business context (CRM/ERP fields, past interactions, policies)

decision rules (when to escalate, when to stop)

a defined action (update CRM, send email, create task)

a human check when risk is high

Integrate just enough to execute

If the AI can’t take action, it becomes another tool people must manage.

Even lightweight integrations, like creating CRM tasks and drafting emails automatically, are often enough to unlock ROI quickly.

Optimize weekly

ROI compounds when you review failures and edge cases, then update rules, prompts, routing, and knowledge sources. Most SMEs don’t need “more AI.” They need iteration.

How B2B GrowthMachine fits when you want ROI, not experiments

B2B GrowthMachine is designed for SMEs that want AI to remove repetitive work and speed up sales and operations through prompting, workflows, and agents, connected to the tools you already use (CRM, ERP, email, Slack, WhatsApp, accounting systems, or APIs).

If your goal is to see ROI early, the fastest path is usually:

Choose one workflow where delay or manual work is clearly expensive

Automate the intake, drafting, routing, and system updates first

Add deeper integrations and continuous optimization once the baseline is beaten

If you want help scoping the first workflow and getting it live with the right guardrails, you can start at B2B GrowthMachine and map the first ROI case from your current processes.